As Jake Rivett would scream, “YAYAYAAYAAAAA!!!!”

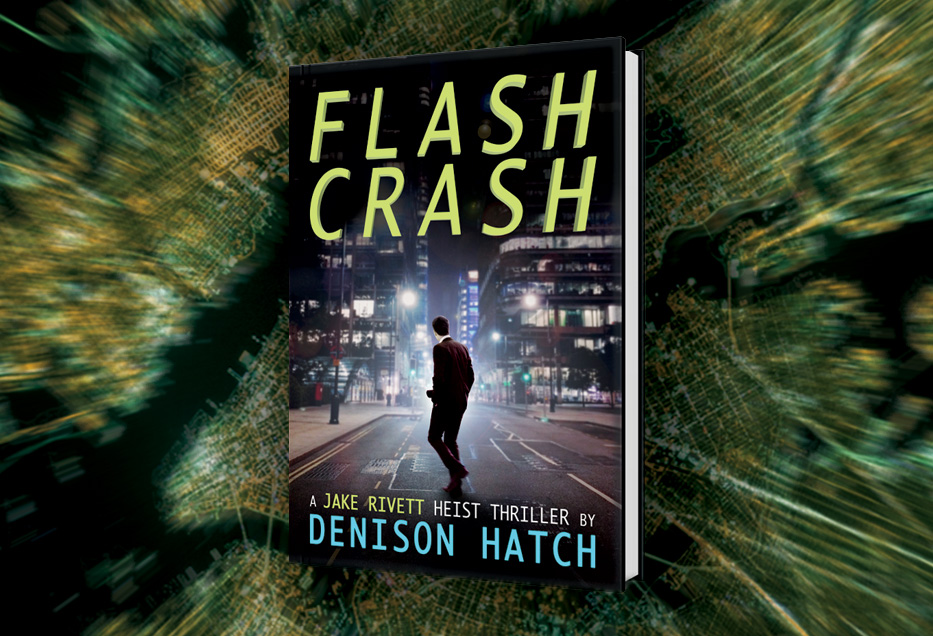

Today my novel, FLASHCRASH, is available on paperback and Kindle from Amazon.com.

I’ve learned an insane amount while writing, editing, and producing this book. Over the course of the next two months, I’m going to make a few posts about cover design and other important lessons that I’ve learned. But right now I’d like to take just a brief moment and talk about why I wrote Flash Crash.

First, I became infatuated with the way that computers, and programs, are controlling Wall Street. The old image—of a Wall Street trader who wears striped Brooks Brothers and operates, as my book describes it, on “luck, spit and a handshake”—is quickly fading from the modern zeitgeist. That person has slowly become replaced by the “quant.” The quantitative analyst or programmer, culled from a growing pool of ambitious PhD, mathematics, and computer science majors, creates computer systems that trade thousands of commodities and equities around the world. What’s more, modern investment banks and secretive-but-powerful hedge funds alike no longer trust the speed of the human brain when it comes to trading. Trading is conducted by super computers, located within inches from the exchanges that they are participating in, and conducting a modern version of electronic combat against one another. Counter-strategies are designed to root out other parties’ strategies. There is, indeed, an arms race occurring within the black boxes that control the modern financial world and it shows no signs of stopping.

This idea enthralled me, and brought about a parallel thought. What if someone could indeed engineer a program that would intentionally crash a particular stock or market?

I had to do my research. It turns out that I wasn’t the first person to think about this. First of all, had something like this ever happened before? It turns out that both mini and major “Flash Crashes” have occurred throughout the market’s history. And they are increasing. A firm called NANEX keeps track of suspicious order flow and volume and subsequent correlation with Flash Crash incidences. It has been proven that there are numerous examples of unexplained crashes in financial markets—and major winners and losers on either side of these events.

But it’s not just Wall Street. “Industrial control switches” is a fancy word for computers that control devices. And they’re everywhere: From a pacemaker in someone’s heart, to the chip in a nuclear centrifuge and everywhere in between.

And I didn’t set out to just write a thriller that took place in front of a computer screen. I love heist movies and novels like The Great Train Robbery and Ocean’s Eleven. Flash Crash starts out in front of a computer–but it definitely doesn’t end there!

With Flash Crash, I attempted to attack the reality of this new twist in the modern zeitgeist head-on. The book is all about controlling the real world through technology. One of our leads is David Belov, a quant who has pulled himself up by the bootstraps at every stage in life. After David is coerced into causing a crash in the gold market and framed for the resulting chaos, he must clear his name. This eventually leads David to literally hack a soda machine in order to create a Trojan horse which will lead him—and his compatriots—into an inaccessible vault buried under four stories of impenetrable granite and completely controlled by computers.

Please check the novel out, write a review on Amazon or Goodreads, and spread the excellent word if you like it!

Thanks so much.